Quality companies are often not hard to spot. The best are well known and trade at a premium valuation as a result. Despite their appeal, quality companies can be risky investments if the price paid is too high. Yet there are times when investors have the opportunity to buy quality at a discounted price, often when cyclical headwinds are conflated with secular concerns, fuelling negative sentiment and fear that the stock is ‘dead money’ with limited near-term upside.

Medpace (MEDP)

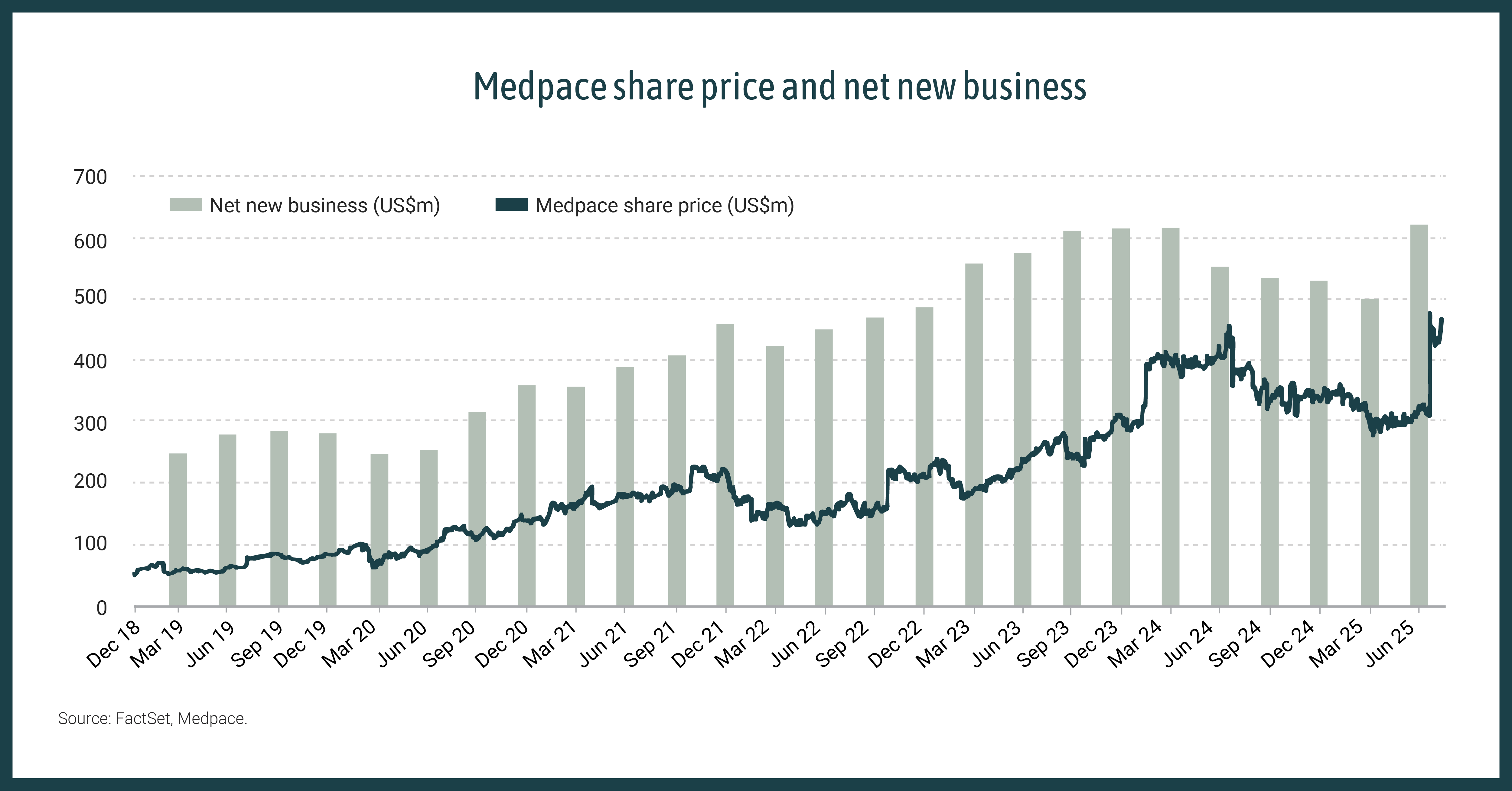

Take Medpace, for example, an investment in the Canopy Global Small & Mid Cap Fund. This founder-led clinical research organisation focuses on small biotechs and boasts an enviable track record: many years of sales growth exceeding 20%, expanding margins and returns, high cash conversion, and no debt. Its sales represent less than 5% of an addressable market expected to grow 10% pa over the long term. However, from mid-2024 Medpace disclosed lower net new business wins for four consecutive quarters, due to an unexpected increase in trial cancellations by its clients, blamed mostly on a weak funding environment. A litany of additional concerns piled on: potential negative impacts from US drug pricing policy changes, cuts to FDA and NIH funding under the new Secretary of Health and Human Services, and pricing pressure from larger competitors. Despite no fundamental change in the scale of unmet medical need addressed by small biotech, or to Medpace's ability to capture this long-term opportunity, the stock was dismissed by many as ‘dead money’ with no obvious near-term catalysts, and its share price declined by one-third over the course of a year.

At Canopy, we believe investing in high-quality companies at the moment of maximum market pessimism can deliver high returns with relatively low risk. Our Fund holds positions in several companies at various points in their dead money journey. In this instance, we increased our investment in Medpace as investor concerns mounted and the share price fell, improving its return potential, even as the recovery timing remained uncertain.

Eventually, the fundamentals reasserted themselves. In Q2, Medpace delivered a surprisingly strong result, with cancellations reverting to normal levels, driving higher net new business growth, which should support higher revenue growth over the coming years. When a positive surprise occurs in a so-called dead money stock, the reaction can be dramatic: Medpace's share price increased 50% the day after the Q2 result. While there was probably no way of predicting the result in advance, the Medpace experience highlights how long term investors can recognise a stumble, as opposed to a fall, and with conviction in the company's long-term prospects, buy quality at a discount.

Source: FactSet, Medpace

Source: FactSet, Medpace