Investing is the pursuit of a return in the face of an uncertain future. While every opportunity involves risk, the concept itself is often not well understood.

What is, and isn’t, risk?

Historically, risk has often been proxied by share price volatility, likely because volatility is easily measured and readily observable. However, volatility is a statistical concept, measured on a backward-looking basis and often over a short time frame, whereas risk is fundamental and forward-looking. Volatile stocks are not necessarily risky if they can be expected to significantly appreciate in value over time. As Morgan Housel has previously noted, “Volatility is the price of admission. The prize inside [is] superior long-term returns. You have to pay the price to get the returns.”

Risk is also sometimes conflated with uncertainty. While related, they are not the same. All investments we make involve some degree of uncertainty—future product launches, management execution, competitive dynamics. But uncertainty is not risky if it is adequately reflected in the share price.

Even less helpful is the view that risk equals deviation from a benchmark. While tracking error may increase an investment manager’s career risk, it has little to do with investment risk. Chasing momentum stocks can seem smart as prices rise — particularly when benchmarks are similarly skewed — but this can be dangerous. Avoiding the easy money rollercoaster may increase tracking error while actually lowering risk.

At Canopy, we define risk as the likelihood of permanent capital loss. That risk is shaped by two factors: the price we pay for an investment, and the future performance of the underlying business.

Alternative histories

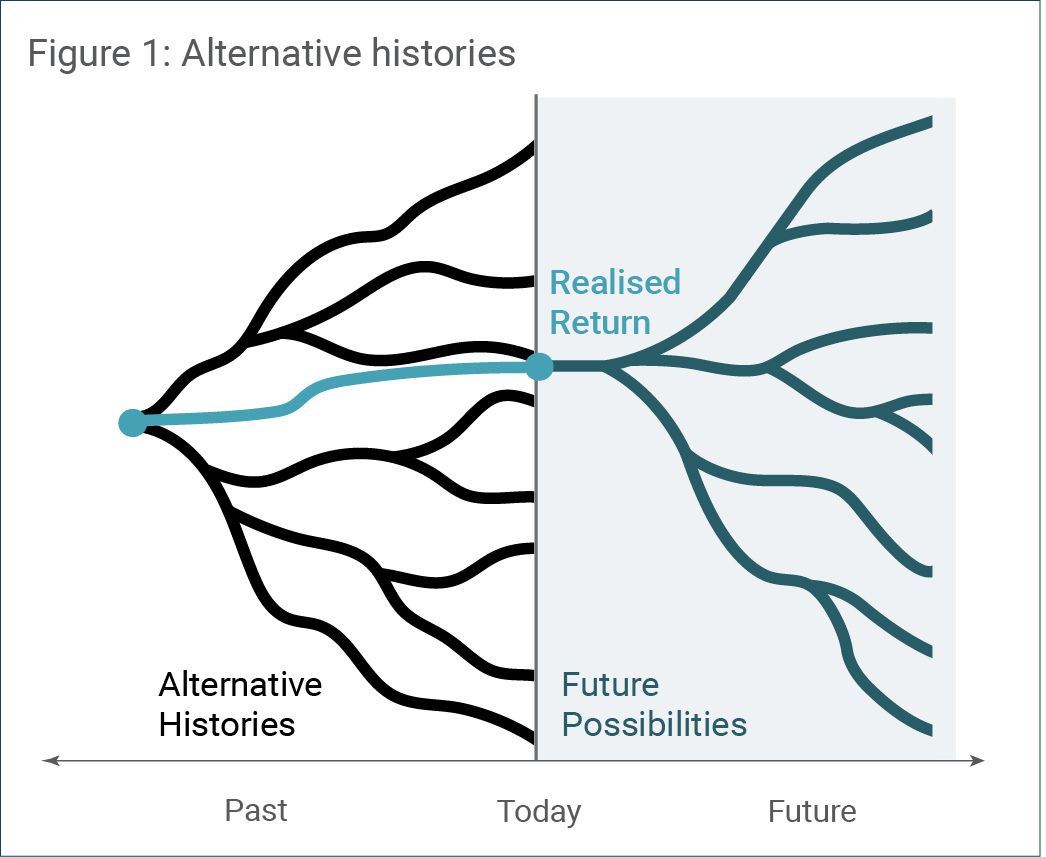

A key implication of the above is that while investment returns are readily observable, the risk taken to achieve them is not. In Fooled by Randomness (2001), Taleb introduces the concept of ‘alternative histories’ – the idea that what actually happened (in this context, a realised return) is only one sample path among many that could have occurred. He argues that our tendency to focus on realised success leads us to underestimate luck and overestimate skill, and by extension, to ignore risk. Figure 1 illustrates the path of alternative histories to a realised return outcome.

Source: Canopy Investors.

This dynamic likely explains much of the well-documented lack of persistence in investment manager returns: in strongly rising markets, the highest returns are often achieved by those who take the most risk, which may unravel when conditions reverse. Gottesman and Morey (2021) support this, showing that funds with high upside capture ratios (outperformance during rising markets) also tend to have high downside capture ratios (underperformance in down-markets).

Howard Marks summarises the concept well in his 2015 memo ‘Risk Revisited Again’: “The celebrated investor is one whose actions yielded good results. Was she lucky or good? How much risk did she take? Since it’s risk-adjusted return that counts, can we tell whether her return was more than commensurate with the risks borne or less than commensurate? I’m confident that the answers lie in skilled, subjective judgments, not highly precise but largely irrelevant ratios of return to volatility.”

Our approach

With that context, our risk management process is designed to minimise the risk of permanent capital loss, while maintaining our exposure to listed companies:

- Our most important risk management tool is buying quality companies at attractive prices. As covered in previous chapters, quality companies have tended to outperform over time, with clear outperformance in down markets. Our insistence on buying with a margin of safety and a favourable skew of investment outcomes provides additional protection while preserving the potential for strong absolute returns.

- Diversification is the only free lunch in investing. While we believe that long term outperformance requires concentration, diversification plays an important role in cushioning the portfolio against unforeseen shocks. The Canopy Global Small & Mid Cap Fund typically holds 20–40 stocks, and our maximum position size is capped at 10%.

- Similarly, we monitor common risk exposures across the portfolio, such as exposure to US housing or the biopharma end-market (we refer to these as ‘identified aggregations’) and limit these to 15%. We also assess correlations among portfolio holdings, which can sometimes reveal hidden aggregation risks not immediately evident at the sector or thematic level.

While we have access to factor and volatility-based risk models, as noted above, they tend to measure backward-looking price movements rather than the probability of permanent capital impairment, and they are consequently less relevant to our risk framework.

Understanding risk

While we believe risk ultimately can’t be eliminated or objectively measured, it can be understood and managed. Our job is to distinguish between share price volatility and actual investment risk, and to construct a portfolio of shares that protects capital while capturing superior long-term returns. At Canopy, that means owning quality businesses trading at attractive prices, sensibly diversifying, and remaining mindful of the risk you don’t see.

Bibliography

Druckenmiller, S. (1994). In J. Schwager, The New Market Wizards: Conversations with America’s Top Traders. HarperBusiness. (Includes quotes attributed to George Soros).

Gottesman, A. A., & Morey, M. R. (2021). What do capture ratios really capture in mutual fund performance? The Journal of Investing, 30(6), 99–112.

Taleb, N. N. (2001). Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets. Random House.

Marks, H. (2015). Risk Revisited Again [Memo]. Oaktree Capital Management.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.