Investing in a company means putting your capital in the hands of managers who decide how it’s used. Managers have access to information you don’t, and their personal incentives may differ from yours. Since people naturally act in their own self-interest, ensuring managers' interests align with yours is critical. At Canopy, we believe the most effective alignment comes through meaningful ownership, whether from founder-operators, family-controlled businesses, or executives with substantial equity positions.

Historical out performance of aligned management

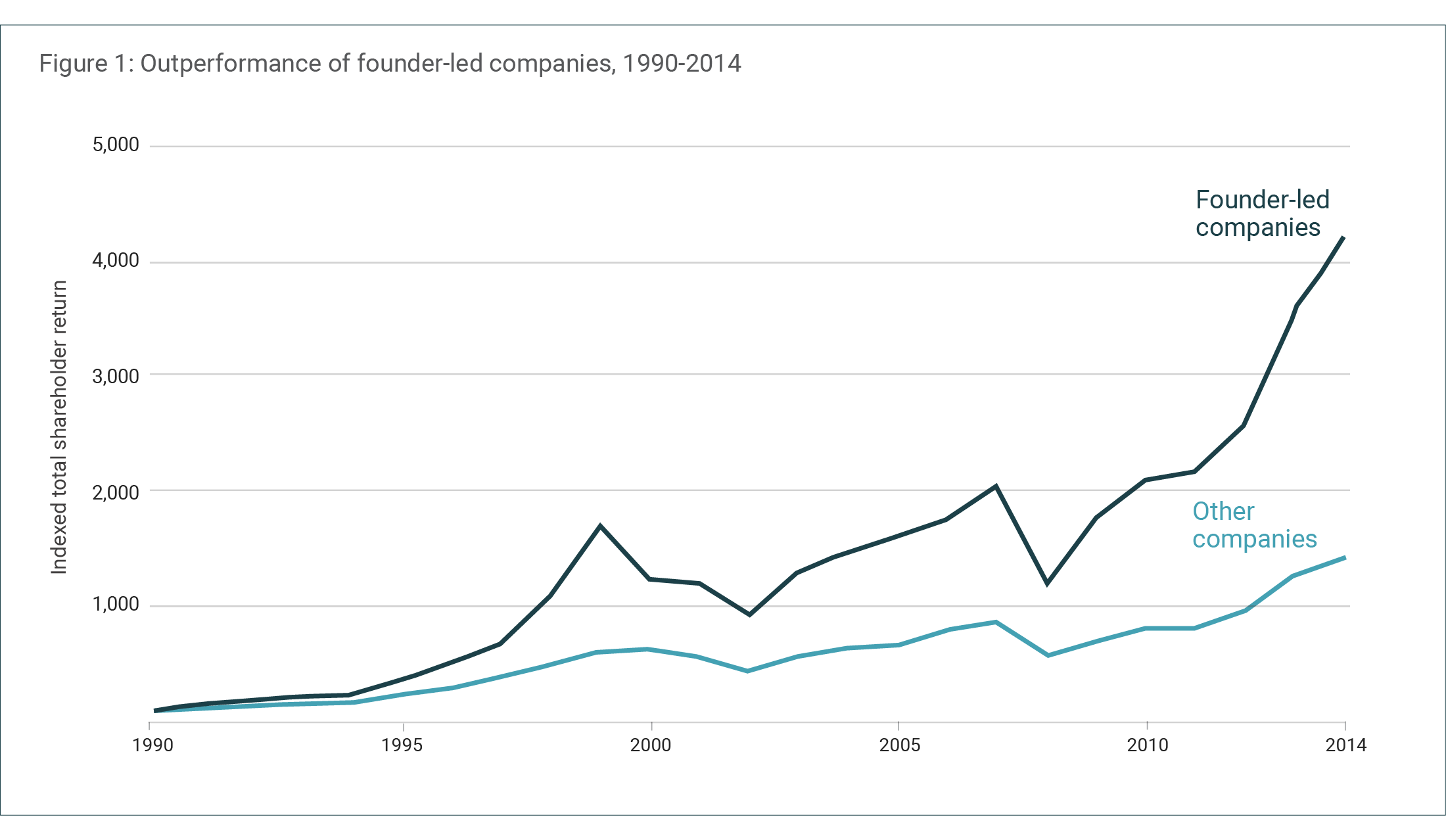

Companies with aligned management consistently outperform their peers. Bain & Company's analysis of S&P 500 firms from 1990 to 2014 showed that founder-led companies delivered cumulative total shareholder returns 3.1 times greater than other companies over this period, as shown in Figure 1 below.

Source: Bain & Company.

Source: Bain & Company.

One might argue this simply reflects the exceptional performance of technology companies over this period, many of which happen to be founder-led. However, even when technology firms were excluded from the analysis, founder-led companies still delivered 1.8 times the returns of their peers.

Academic research suggests this outperformance stems partly from differences in how founder-led companies allocate capital and innovate. Fahlenbrach's 2009 study of 2,327 firms from 1992-2002 showed founder-led companies invested 22% more in R&D and 38% more in capital expenditures than their non-founder-led peers, and delivered annual share price outperformance of 8.3% even adjusting for risk factors. This combination - higher investment and superior returns - demonstrates that founder-CEOs don't just spend more on growth, they're better at selecting which investments will create value.

Lee, Kim, and Bae's study of S&P 500 companies from 1993 to 2003 showed founder-led companies generated 31% higher citation-weighted patent performance (a measure of innovation impact) versus non-founder-led companies. The advantage remained at 23% even after controlling for higher R&D spending, indicating they innovate more efficiently. The study also found that founder-led companies tend to produce more breakthrough innovations (patents in the top 5% by citations).

However, alignment does not universally drive optimal outcomes. Morck, Shleifer, and Vishny's 1988 study of 371 Fortune 500 firms revealed an inverted U-shaped relationship between management ownership and firm value. The study found firm performance improved substantially when managers increased their ownership positions above 5%, but then declined again as ownership levels increased beyond 20%, potentially indicating entrenchment and value destruction.

This entrenchment effect is particularly pronounced in family-controlled firms. The Morck study found evidence that older firms run by founding family members underperformed compared to those led by unrelated officers. As family ownership stakes increase beyond optimal levels, concentrated voting control can insulate management from market discipline and traditional governance mechanisms. Entrenchment risk may manifest through nepotism in senior appointments, excessive compensation, retention of underperforming family executives, resistance to strategic changes that threaten control, and conservative financial policies that prioritise stability over growth.

The ownership mindset

We believe companies with properly aligned management teams outperform for several fundamental reasons:

- Long-term perspective: When managers have significant personal wealth tied to company performance and expect to remain with the business, they think and plan over fundamentally longer time horizons. In contrast, professional managers without meaningful ownership often face quarterly earnings pressure, shorter tenure expectations, and career advancement timelines that encourage more immediate results.

- Faster decision-making: When founders or aligned managers have clear ownership stakes and authority, they can make critical decisions quickly without navigating competing interests or extensive approval processes. Professional managers often face more complex stakeholder dynamics and committee structures that slow decision-making.

- Risk tolerance for innovation: Founders are often more willing to cannibalize their own products or pursue disruptive innovations, while professional managers at large companies may be incentivized to protect existing revenue streams and avoid career-threatening risks.

- Cultural cohesion: When managers have long-term ownership stakes, they're more likely to invest in building a strong workplace culture, employee development, and talent retention since they'll benefit from the long-term performance gains.

Our approach

At Canopy, we prefer to invest in companies with aligned management teams who have meaningful skin in the game, while avoiding any added governance risk. In evaluating alignment, we examine:

- Evidence of long-term thinking and capital allocation discipline including minimal focus on short-term guidance, willingness to invest through cycles, and track records of value-accretive investments, acquisitions, and capital returns.

- Ownership and remuneration structures to understand how much management wealth is tied to company performance, and whether performance hurdles are sufficiently ambitious.

- Management communication style that provides clear, honest discussion of strategy challenges with shareholders.

- Third-party perspectives from former employees, competitors, and other stakeholders to understand culture and decision-making patterns.

- Treatment of stakeholders during challenging periods such as layoff decisions, supplier relationships, customer pricing, or stock option repricing, which often reveals priorities better than any formal governance structure.

- Red flags associated with concentrated ownership, such as excessive compensation relative to performance, frequent strategic pivots, poor communication with shareholders, or prioritizing individual or family employment over competence.

Importantly, we practice what we preach. Each Canopy team member is both a shareholder in the company and an investor in the Canopy Global Small & Mid Cap Fund, with our personal investments representing our largest holdings outside our homes. Further, the performance fee structure of our Fund aligns our interests with clients; we only earn fees when we deliver both positive returns and outperform our benchmark, with caps and clawbacks ensuring we're rewarded for consistent performance rather than short-term gains.

We believe companies with aligned management possess significant advantages that compound over time. These advantages are particularly pronounced among small and mid-cap companies, where management decisions can have an outsized impact. Incentives shape behaviour, and behaviour drives results.

Bibliography

Fahlenbrach, R. (2009). Founder-CEOs, Investment Decisions, and Stock Market Performance. Journal of Financial and Quantitative Analysis, 44(2), 439-466.

Lee, J. M., Kim, J., & Bae, J. (2016). Founder CEOs and Innovation: Evidence from S&P 500 Firms. Working Paper, Krannert School of Management, Purdue University.

Morck, R., Shleifer, A., & Vishny, R. W. (1988). Management Ownership and Market Valuation. Journal of Financial Economics, 20, 293-315.

Zook, C. (2016). Founder-Led Companies Outperform the Rest — Here's Why. Harvard Business Review.

Zook, C., & Allen, J. (2016). Barriers and Pathways to Sustainable Growth: Harnessing the Power of the Founder's Mentality. Bain & Company.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.