Like maintaining a healthy diet and exercise routine, sound investment principles are simple to explain but difficult to execute. The challenge isn't understanding that you should buy quality companies at attractive prices - it's maintaining discipline when the approach is out of favour, others are profiting from speculation, and patience is tested. At Canopy, we believe having a logical investment process that can be applied consistently is critical to achieving this over the long term.

The magic formula's lesson

In The Little Book That Beats The Market (2005), Joel Greenblatt outlined an elegantly simple investment strategy. He ranked all stocks by return on capital (a measure of quality) and earnings yield (a measure of value), purchased equal-weighted positions in the highest-ranked 30 stocks, and rebalanced annually. This ‘magic formula’ portfolio outperformed the market in every rolling ten-year period from 1988 to 2004.

The strategy worked, but with an important catch. Within each successful ten-year period, there were stretches lasting up to three years where it underperformed, sometimes significantly. Investors who stayed the course captured the superior long-term returns, while those who abandoned it during difficult periods did not. The formula was straightforward and could be replicated by any investor. The barrier to success wasn't complexity or access to information, but temperament. This pattern repeats across many successful investment strategies: the approach matters, but the ability to stick with it through inevitable difficult periods matters just as much.

Why process matters

A well-designed investment process serves several crucial purposes beyond simply organising your work:

- Drives repeatability: A documented process ensures you consistently apply your investment philosophy rather than making ad hoc decisions. We believe success is driven by consistently behaving in a methodical way, not from random, occasional flashes of brilliance.

- Creates accountability: A formal process creates commitment to your stated approach. It's much easier to avoid making emotional decisions when doing so requires consciously deviating from your framework.

- Distinguishes noise from signal: Markets are volatile, the future is uncertain, and individual positions can underperform for many reasons. A systematic process helps you evaluate whether poor performance reflects a broken thesis or simply short-term market noise.

- Enables systematic learning: When you capture your thinking at each decision point - the quality assessment, valuation rationale, risks identified, and conviction level - you create a record that can be honestly evaluated later. This prevents hindsight bias (convincing yourself you "knew it all along") and allows you to identify patterns to drive systematic improvements.

- Supports collaboration: In a team environment, a documented process ensures investment knowledge isn't locked in any single person's head. When decisions, research, and company interactions are systematically recorded, team members can effectively challenge each other's thinking and provide continuity when someone is unavailable.

- Manages discipline versus rigidity: There's an important distinction between process discipline and inflexibility. A good investment process should be robust enough to minimize flawed decision-making, yet flexible enough to incorporate new information. The key is understanding what aspects are fundamental to your philosophy (these should rarely change) versus those that should evolve as you learn. For us, the principle of only investing in high-quality companies at attractive prices is fundamental, while the specific metrics used to assess quality and value can be refined over time.

Our approach

In the first nine chapters of our handbook, we outlined the key tenets of Canopy's investment philosophy. In summary, we focus on global small and mid-sized companies because we believe this segment is opportunity-rich. We identify and rank our investments by quality, valuation, and conviction. We make decisions as long-term owners. We aim to minimise the risk of permanent capital loss and the impact of behavioural biases. And we avoid relying on forecasting market or macro outcomes.

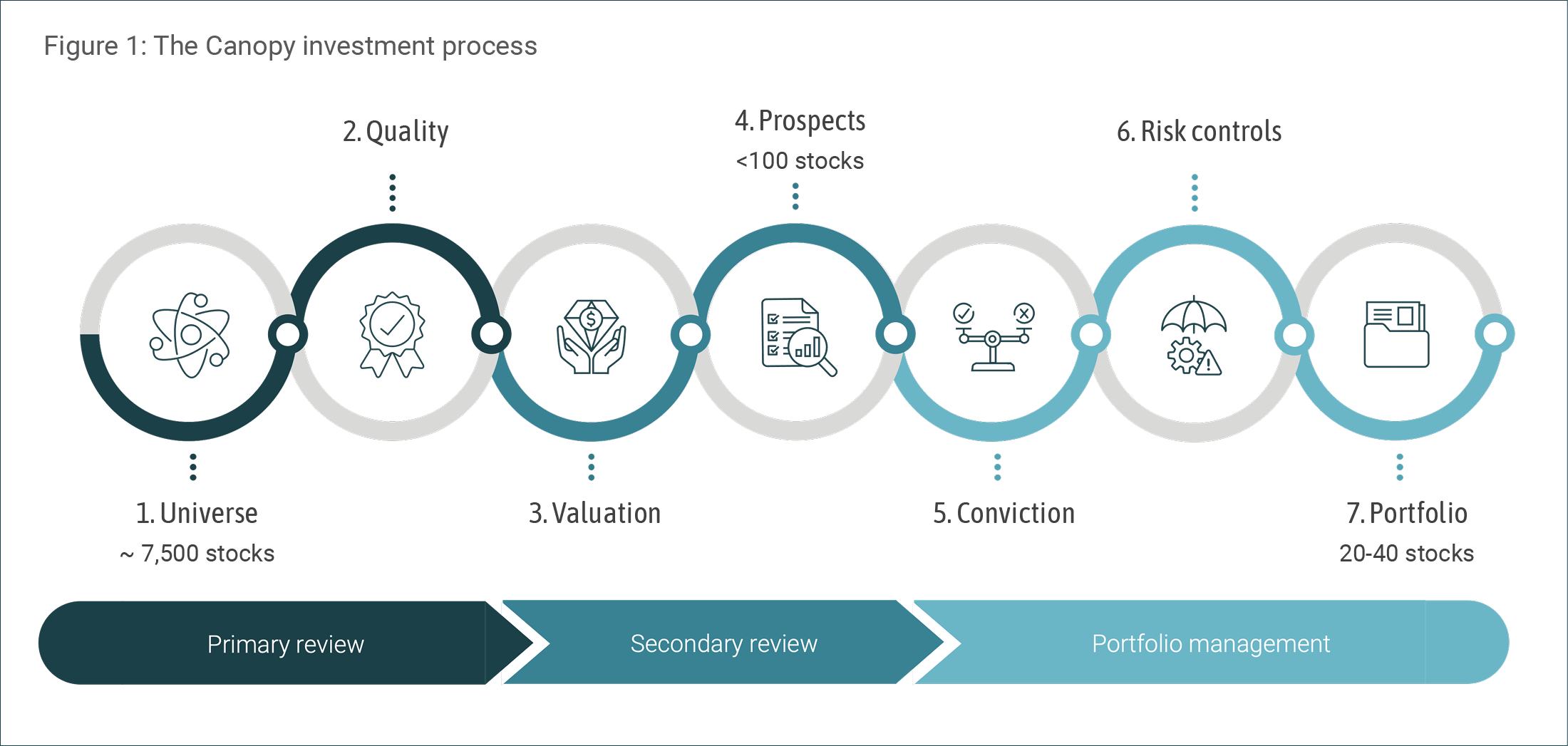

To apply these principles consistently, we have built them into a structured seven-step framework, illustrated below, that guides every investment decision we make.

Source: Canopy Investors

Source: Canopy Investors

Our process is deliberately straightforward: systematically screen for candidates, conduct deep fundamental research on business quality and valuation, maintain a curated prospects list, size positions based on quality, expected returns and conviction, and continuously monitor for changes that warrant action.

To execute this process consistently, we have invested in a purpose-built technology infrastructure. Our cloud-based research and portfolio management platform integrates all aspects of our workflow - from initial screening and research documentation to conviction tracking and portfolio construction. Every qualitative and quantitative assessment is recorded in this system at the time it's made, creating a complete record of our thinking. We also use advanced analytical tools, including generative AI capabilities, to improve and accelerate our research and decision making. As these technologies continue to evolve, our platform and process is flexible enough to integrate new capabilities while maintaining our fundamental framework. The goal is to leverage technology to execute our philosophy more effectively, not to change what we believe works.

Relatedly, we believe a consistent investment process is more challenging to implement as the team size increases. Research consistently shows that smaller teams outperform larger ones, as coordination requirements increase exponentially with size (Hackman, 2009). We have structured Canopy as a small team of experienced investors by design. One of the key benefits of improving technology is the ability to increase the productivity of our team, allowing us to turn over more rocks without sacrificing adherence to our process.

The principles underlying our investment approach are straightforward. The competitive advantage comes not from knowing them, but from applying them consistently, especially when doing so is most difficult. Process provides a way to do this; temperament determines whether you can.

Bibliography

Greenblatt, J. (2005). The Little Book That Beats the Market. John Wiley & Sons.

Hackman, J.R. (2009). Why Teams Don't Work. Harvard Business Review, May.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.