Shares are ownership stakes in real businesses. Buying a share means becoming a part-owner, with your investment tied to the company’s assets and future earnings capacity. However, many market participants ignore this reality, treating shares as ticker symbols to be traded for quick profits. This is speculation, and while it can work for short periods, our experience is that adopting a long-term ownership mentality tends to deliver superior results over extended periods.

Long-term benefits

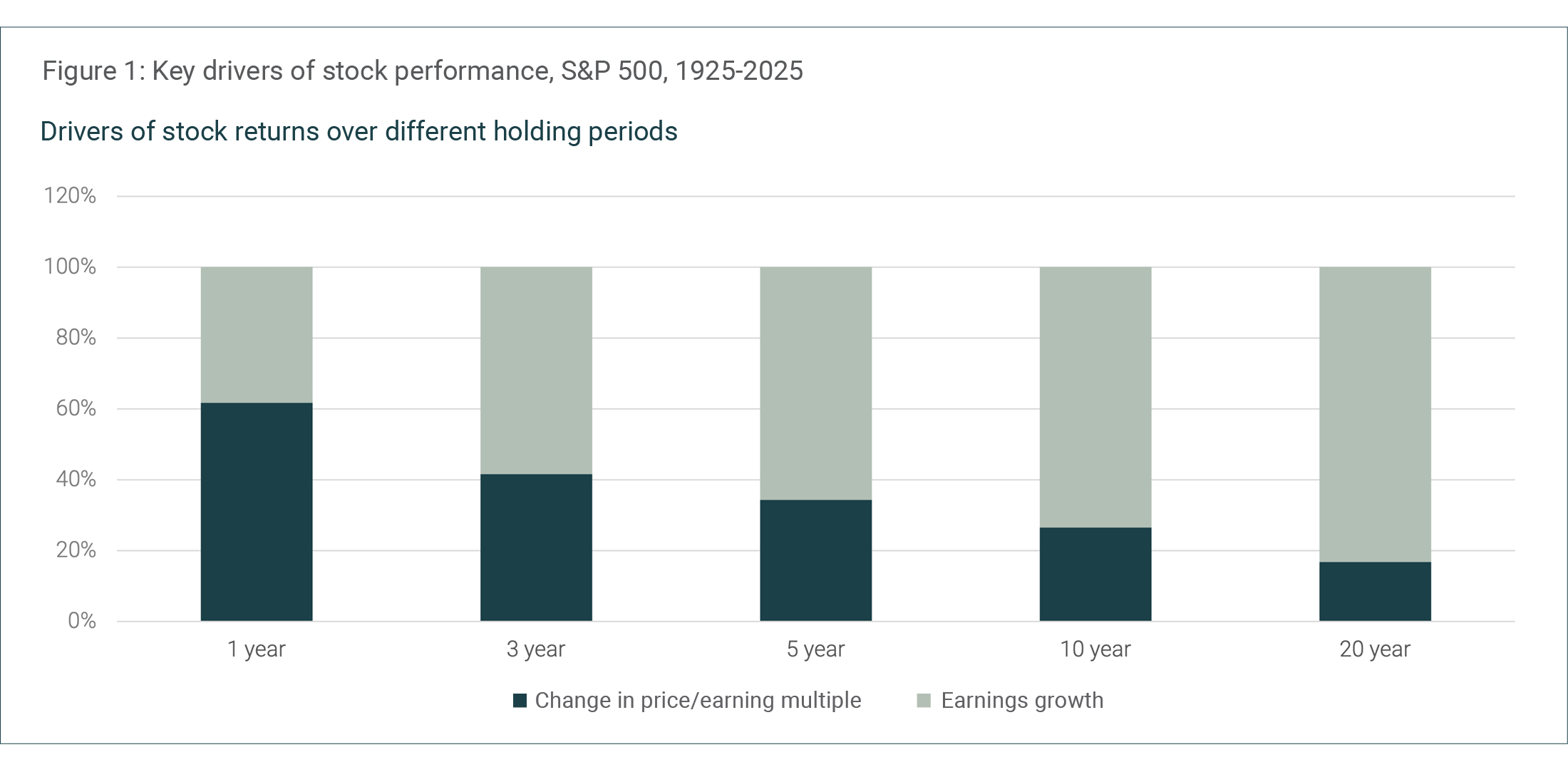

In the short term, share prices are primarily influenced by non-fundamental factors: investor sentiment, liquidity flows, momentum trading, and shifting market narratives. As illustrated in Figure 1, more than 60% of one-year equity returns are driven by changes in valuation multiples, which often reflect market psychology rather than durable changes in business value.

However, as the investment horizon extends, the correlation between share prices and underlying business performance strengthens significantly. Over a twenty-year period, less than 20% of total returns are attributable to changes in the valuation multiples, with earnings growth accounting for the vast majority of investment outcomes. This shift in return composition highlights a fundamental principle: the shorter the investment horizon, the more that performance is driven by sentiment, luck and randomness; the longer the horizon, the more that business fundamentals determine investment results.

Source: Schiller, Canopy Investors. Data used in ‘Irrational Exuberance’, Princeton University Press, updated. www.shillerdata.com.

Source: Schiller, Canopy Investors. Data used in ‘Irrational Exuberance’, Princeton University Press, updated. www.shillerdata.com.

Cremers and Pareek (2016) found that among investment managers with portfolios substantially different from their benchmarks, only those who held positions for extended periods (typically over two years) consistently outperformed. Their study demonstrated that patient, high-conviction investors generated excess returns of 2.3% annually - evidence that patient capital is rewarded. A long-term horizon not only improves the chances of successful investment outcomes, it also reduces transaction costs and minimizes taxes on realized capital gains.

Market myopia

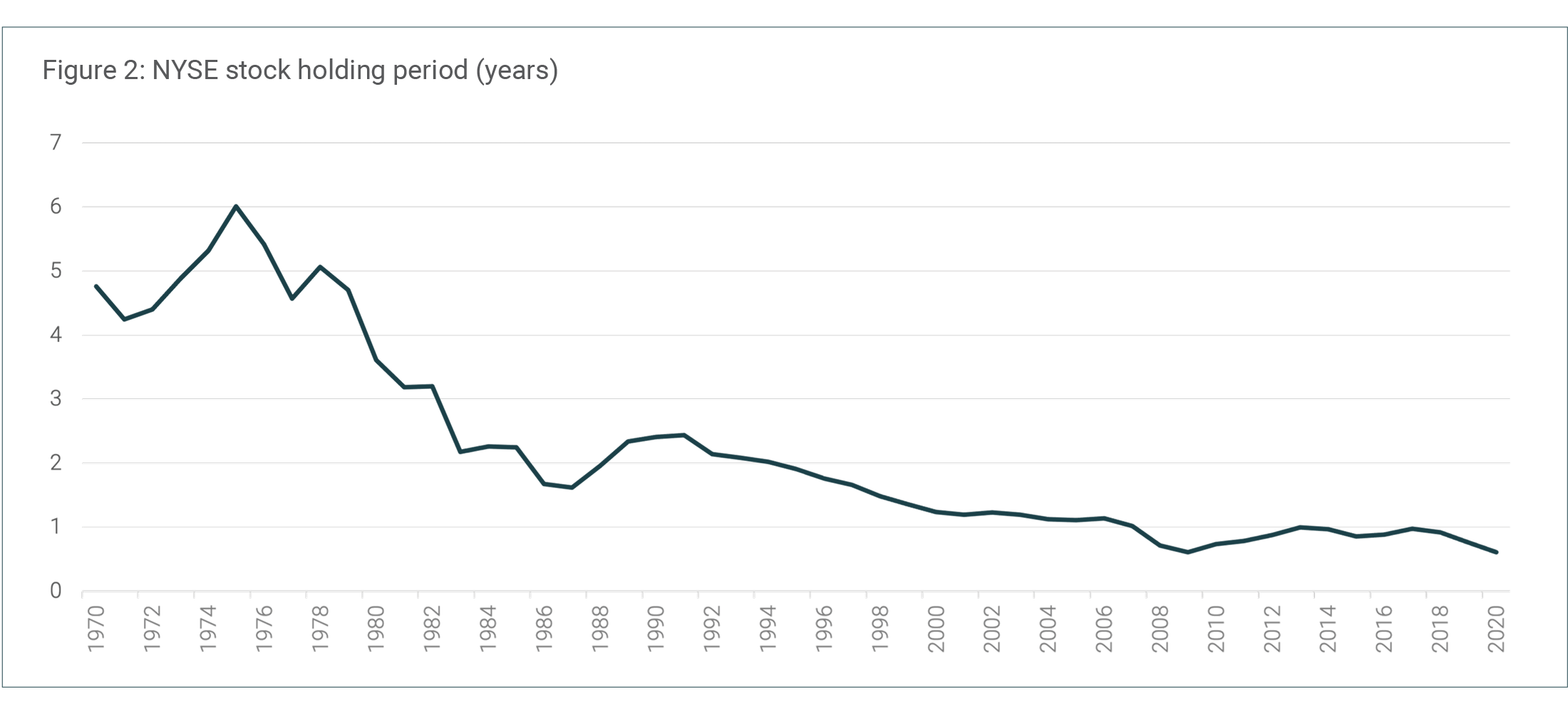

Despite the benefits of long-term investing, markets have become increasingly short-term focused. As shown in Figure 2, average stock holding periods have collapsed from approximately five years in the 1970s to under six months today.

Source: NYSE, Refinitiv, 2020.

Source: NYSE, Refinitiv, 2020.

In part this shift has been driven by:

- High-frequency trading: Quantitative high-frequency strategies, enabled by automated trading systems and advances in computation and networking, now account for a significant portion of daily trading volume.

- Alternative data and hedge fund strategies: Multi-strategy hedge funds (‘pod shops’) increasingly employ real-time alternative data sources to speculate on near-term price movements and quarterly earnings surprises—from satellite imagery of retail parking lots to consumer spending patterns.

- Increased retail speculation: Low-cost trading platforms, gamified investment apps, and derivative products such as zero-day options have made speculation more accessible and appealing to retail investors, further amplified by social media generating FOMO (fear of missing out).

- Institutional pressures: Professional investors face career risk and institutional pressure to deliver short-term performance. As John Maynard Keynes observed, “Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.”

Even fundamental investors face pressure to focus on short-term price movements due to clients’ concerns about short-term relative performance. We often find opportunity precisely when others lose patience. When market participants dismiss a high-quality, secularly growing company as ‘dead money’ because it faces 1-2 years of weaker performance—regardless of its valuation—our interest is immediately sparked.

Duration arbitrage

Increasing market myopia and volatility may make the journey bumpier, but can also provide valuable opportunities for long-term, fundamentally driven investors. We call this ‘duration arbitrage’–the ability to capitalize on mispricing that occurs when the market’s short-term focus creates a disconnect with long-term business fundamentals.

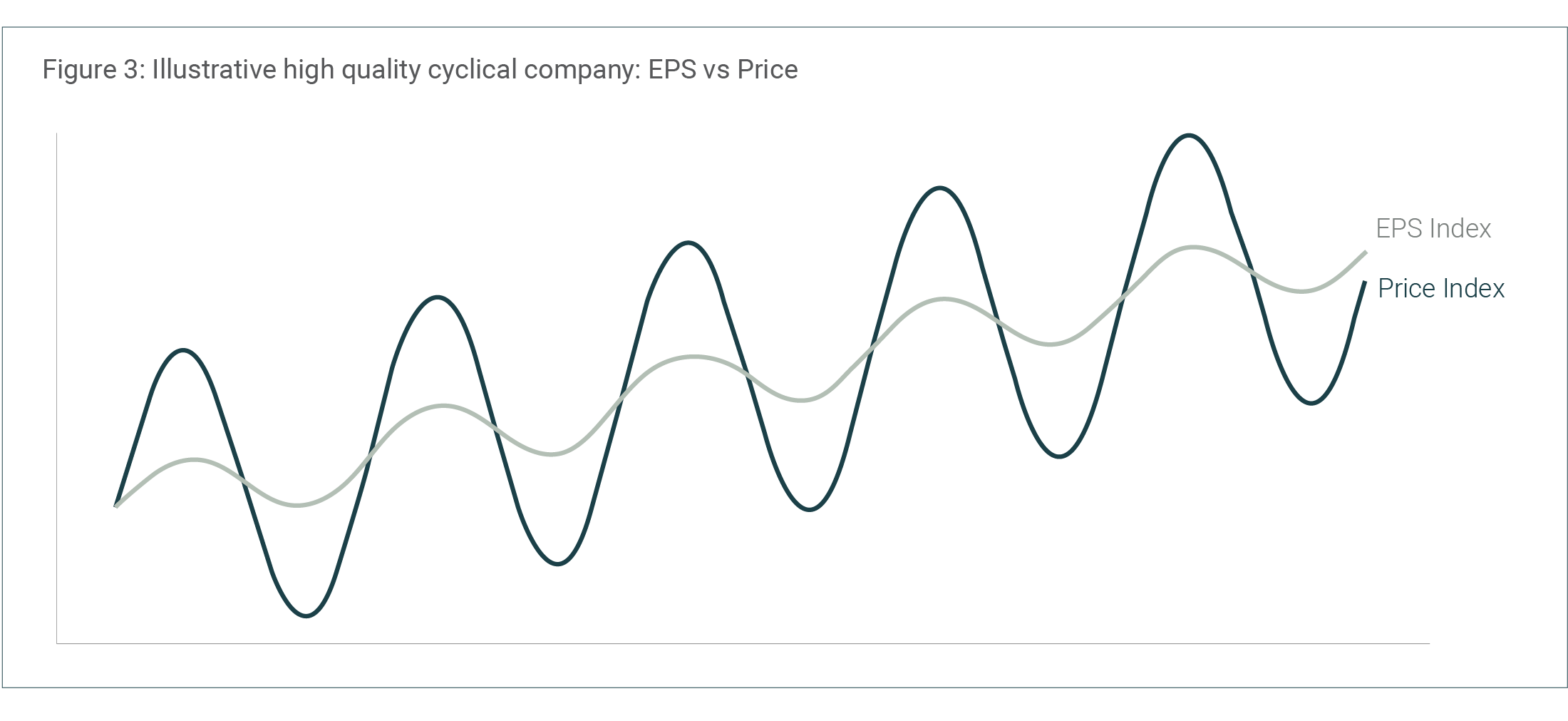

For example, high-quality companies with cyclical end markets often see exaggerated share price movements around periods of cyclical weakness, which are almost always accompanied by fears of ongoing secular challenges. These temporary setbacks frequently lead to significant share price declines as short-term investors rush to exit, creating compelling opportunities for patient investors who understand the business’s long-term trajectory. As Howard Marks observed “in the real world, things generally fluctuate between ‘pretty good’ and ‘not so hot.’ But in the world of investing, perception often swings from ‘flawless’ to ‘hopeless.’”

Source: Canopy Investors.

Source: Canopy Investors.

Our approach

At Canopy, we are long-term investors who view market myopia as a sustainable and abundant source of alpha. When high-quality companies experience share price volatility due to short-term concerns, we look to take advantage–provided our research indicates the long-term investment thesis remains intact. We believe that the conviction we build through deep, fundamental research enables us to see through market noise and act with confidence when opportunities arise.

Our focus on the long term naturally also results in lower portfolio turnover than short-term strategies, reducing transaction costs and tax implications from realized capital gains. However, in volatile markets where sentiment fluctuates wildly, our long-term approach can still result in more trading. We are not simply buying and holding forever – we continuously evaluate our holdings against our quality and valuation criteria, as well as relative to the next best opportunities available to us.

Investing like an owner

The forces driving greater market myopia seem likely to persist. While this environment may lead to a more volatile investment journey, we believe that remaining disciplined with a long-term focus provides a competitive advantage in delivering superior returns in a market increasingly driven by short-term sentiment.

Bibliography

BCremers, M., & Pareek, A. (2016). “Patient capital outperformance: The investment skill of high active share managers who trade infrequently.” Journal of Financial Economics, 122(2), 288-306.

Graham, Benjamin. (1949). The Intelligent Investor. Harper & Brothers.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.