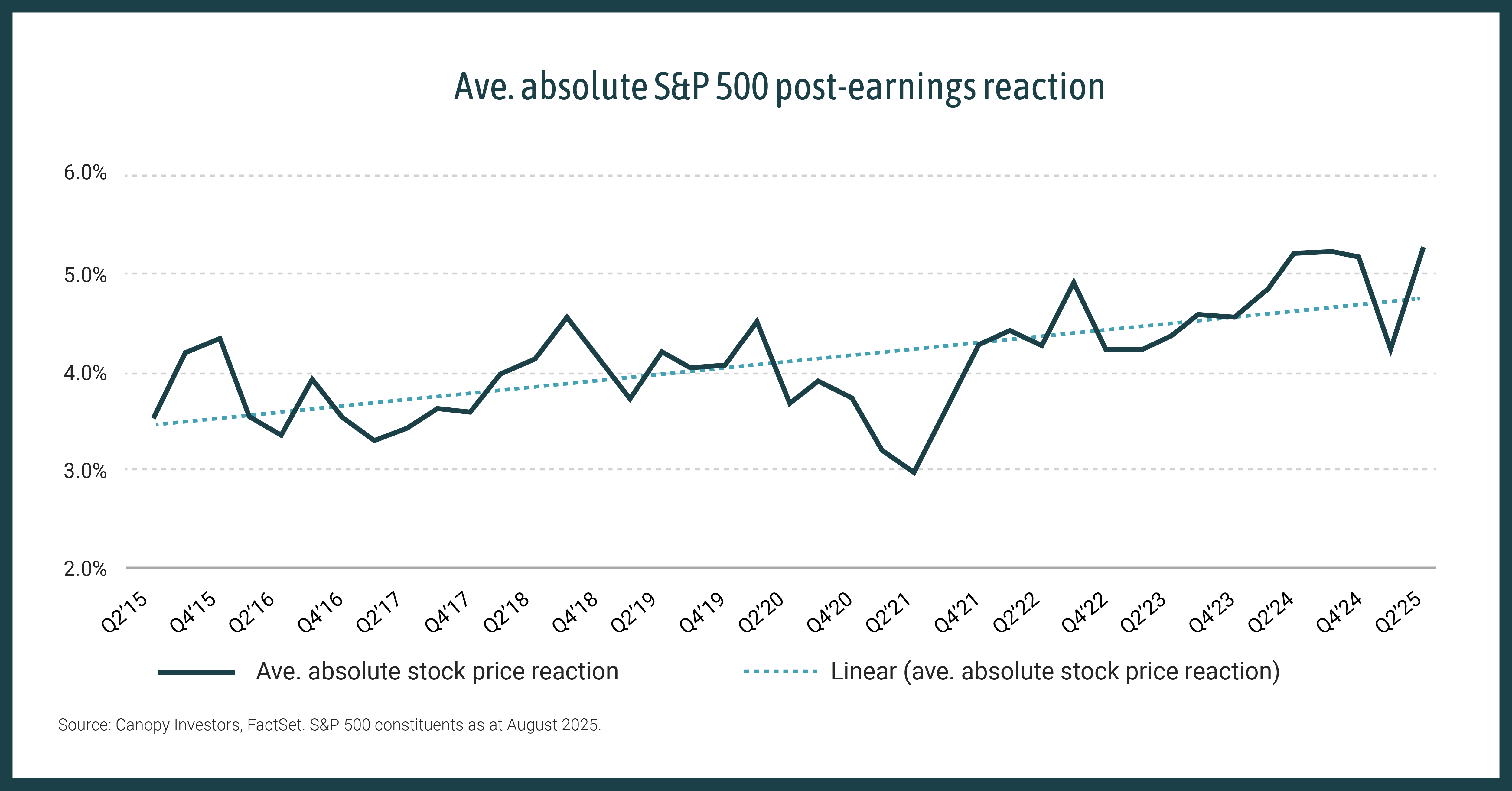

This is true both in Australia, where we’ve seen some large moves in big companies, as well as in the US. As shown below, we estimate that the average post-earnings reaction for S&P 500 companies is now more than ±5%, a significant increase compared with a decade ago. The frequency of ±10% post-earnings moves has also doubled.

Why is this happening?

There are a few potential explanations:

- Passive investing: The increased allocation to passive funds and ETFs has likely had an impact. In effect, earnings surprises now have to be absorbed by a smaller pool of active, price-setting investors, with volatility amplified by passive fund rebalancing. According to Morningstar, as at August 2025 there are now more listed ETFs in the US than actual stocks, many of them thematic or leveraged.

- Shorter time horizons: In the 1970s, the average investor holding period for a stock was about five years. Today, it’s under six months and likely falling. The rise of high-frequency and algorithmic trading strategies, along with multi-strategy hedge funds speculating on earnings surprises, has played a role. A more recent development is investors using AI tools like ChatGPT to trade quarterly results. There’s some evidence that trading volumes drop noticeably during ChatGPT outages, for example.

- Retail speculation: Retail trading activity may also be contributing, supported by trading platforms like Robinhood, along with record levels of margin debt (investors borrowing to trade stocks) and short-term options volumes.

These trends are long-term and likely structural – the new normal. For long-term investors, the opportunity lies in harnessing this volatility to their advantage.